Here’s a simple budget tool that you can apply all over the place. The first thing you need to do is measure your gap. The math is dead simple: subtract expenses from your income and the difference is your Gap.

Continue reading →

Here’s a simple budget tool that you can apply all over the place. The first thing you need to do is measure your gap. The math is dead simple: subtract expenses from your income and the difference is your Gap.

Continue reading →

Retirement plans are unique to individuals. Circumstances vary wildly, from financial position to personal goals to where you choose to live. So don’t think we think our plan will work for anyone other than us. To be honest, it’s a big assumption our plan will work at all ![]()

I do have a core philosophy: own the plan. I get the temptation to “have a guy” that sorts it all out. There’s a ton of complexity, misinformation, and uncertainty. There’s no real way to know if you’ve got it figured out or if you’ve got it all wrong.

Continue reading →

This book is pretty foundational to our “own it” strategy. I found it to be full of good advice and demystified financial planning. The author is a financial journalist so the book is very approachable and even funny at times.

I’m fairly risk-adverse so it was a revelation when I realized how damaging inflation can be to any plan. The scary headline? Things that cost $100 today could cost twice that in 20 or 30 years!

Continue reading →

Just attended a “webinar” this morning on long-term care (LTC) coverage planning. What’s that, you ask? Well, basically, it’s planning to pay for any kind of assisted living costs. And, trust me, you’re very likely to need a plan here.

Continue reading →

I’m really used to getting a paycheck. I’ve been working since I was 14 and truly value the security that comes from a regular income. The scariest thing about retirement (for me) was giving up that security. I’ve never been a very good saver; I’m more of a spender as it turns out. The idea of giving a paycheck up spooks the crap out of me.

Continue reading →

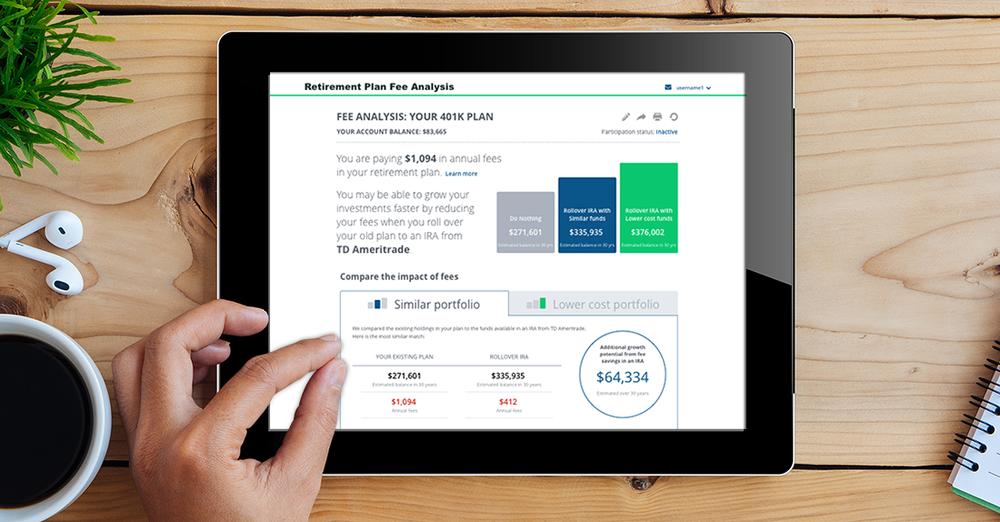

Many of us will rely on 401k withdrawls to extend social security income. If you’re lucky enough to have an employer-sponsored plan – especially if your employer matches any part of your contributions – you should really be putting money in it. I’m bummed that the IRS sets a limit on how much you can contribute every year ($26k if you’re over 50) but it’s held in a tax-free account and you can often choose how to invest so still a good deal.

Continue reading →

NerdWallet Tax Calculator

In my last post I talked about how to manage your 401k. But, when the time comes, what’s the formula for withdrawing?

Continue reading →

Clearly there’s a LOT to think about with your 401k. There’s managing it prior to retirement. There’s planning out how much to withdraw every year. This post on 401ks is about managing the 401k AFTER you retire.

I hadn’t really thought about it but, unless you’re planning to just take everything out of your 401k on day one of your retirement (pro tip: don’t do that) then you’ll need to manage it for the rest of your life*. How you do that will be like any other investment: what do you need – growth or stability, or some kind of mix? Like I keep saying, that’s up to you to sort. But here’s what I think.

Continue reading →

I feel pretty confident that, between Social Security and 401k and other income sources, we’ll be ok for retirement. But that’s based on my limited comprehension of what it means to replace a paycheck with savings. And I like the security of a regular paycheck. So maybe I keep working even in retirement – at least in a limited capacity.

Mental health may be an even bigger benefit of the side hustle. I’ve seen many folks hit retirement only to find themselves lost and bored. Don’t find yourself at 67 wondering “ok, now what am I gonna do?”

Continue reading →