Many of us will rely on 401k withdrawls to extend social security income. If you’re lucky enough to have an employer-sponsored plan – especially if your employer matches any part of your contributions – you should really be putting money in it. I’m bummed that the IRS sets a limit on how much you can contribute every year ($26k if you’re over 50) but it’s held in a tax-free account and you can often choose how to invest so still a good deal.

What if you don’t have an employer sponsored 401k? You can open your own Investment Retirement Account (IRA). There are several options like a Roth but, honestly, I don’t know much about them. Do your research and report back here if so inclined!

The tough challenge with 401ks is figuring out how to ensure it grows a ton while you’re working. you can You maximize your 401k by managing two factors: fees and investment choices.

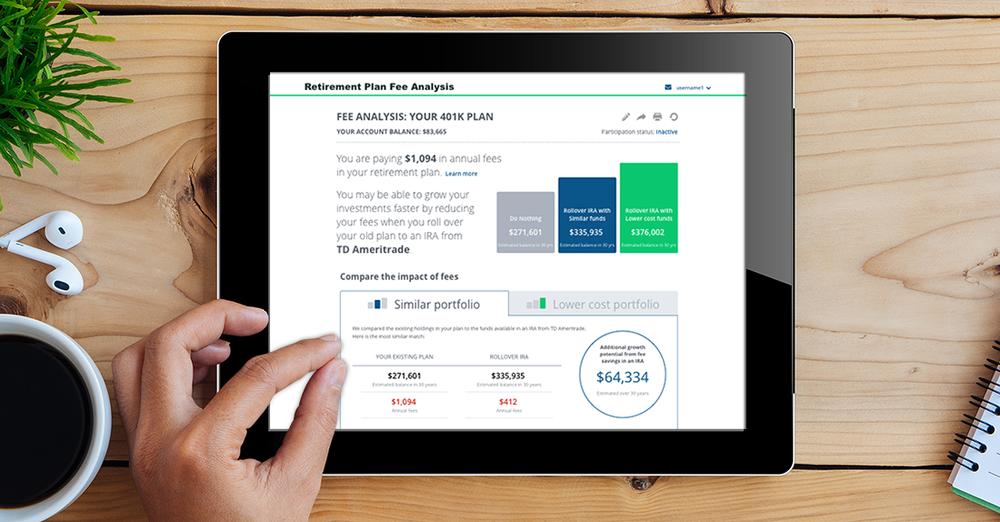

You need to make sure whatever 401k fund (or funds) you’ve chosen aren’t bogged down with fees. Most advisors encourage you to pick “no load” funds, meaning there investing them involves little to no cost to you. Figuring out what you’re paying now is a whole lot easier if you use a tool like FeeX from TD Ameritrade. It analyzes your 401k and reports back what is getting skimmed off the top by your financial institution:

https://401kfeeanalyzer.tdameritrade.com/auth/signup.html

The harder part is picking a fund in which to invest. There are a ton of products out there and not all are universally available. I was surprised to learn that plan options are negotiated by your employer; you may not be able to access products available elsewhere. But most have similar funds so you just poke around a bit to find one that suits your strategy.

Our strategy is pretty vanilla: part of our investment is in S&P 500 market index funds and part is in bond market index funds. What are index funds? Simply put, they’re near autonomous funds that invest in market indexes (collections of stocks or bonds). Read more here:

READ ARTICLE: https://www.nerdwallet.com/article/investing/index?trk_location=ssrp&trk_query=market%20index%20fund&trk_page=1&trk_position=3

The thing I love about index funds is they rise and fall with the broader market but in smaller swings. Index funds also come with lower fees. Financial gurus and numerous studies have shown that the S&P 500 market index funds typically outperform more managed portfolios. So, basically, they’re relatively safe and relatively cheap.

Why stocks AND bonds? Well, I’ll write more about that later, but the short of it is you do both to insulate yourself from risk. Stocks generate growth (meaning more money in the future) and bonds provide stability (so you have something secure if stocks tank).

What percentage you put in each depends on your needs and tolerance for risk. For example, if you need a lot of growth you probably want to put more in stocks. If you’re good with your 401k balance then, maybe, you shift more to bonds. Personally we want growth growth growth, so we are heavy in stock. But that’s a personal call and not one you should just follow without careful consideration.

PS – here’s a good primer on the various kinds of 401k funds might be available in your plan: https://www.nerdwallet.com/article/investing/retirement-investments-beginners-guide?trk_location=ssrp&trk_query=managing%20ira&trk_page=1&trk_position=4