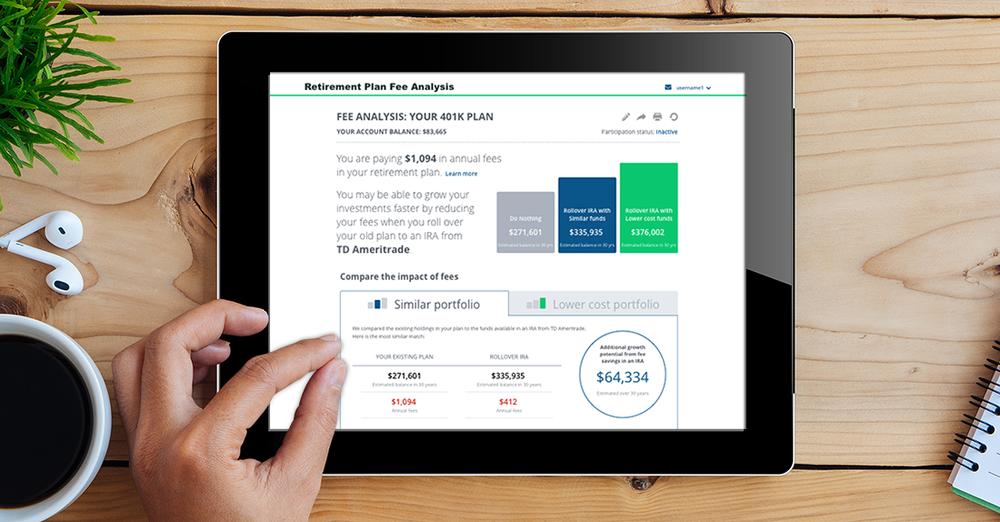

Many of us will rely on 401k withdrawls to extend social security income. If you’re lucky enough to have an employer-sponsored plan – especially if your employer matches any part of your contributions – you should really be putting money in it. I’m bummed that the IRS sets a limit on how much you can contribute every year ($26k if you’re over 50) but it’s held in a tax-free account and you can often choose how to invest so still a good deal.

Continue reading →