Retirement planning is hard. Sure, there are simple techniques anyone can use to map a path. Yet those techniques require data and effort. Most people don’t want to spend precious free time crunching numbers and making tough, life-impacting decisions. Most people – myself included – would rather find someone who can just take care of it. You know, a Guy (here used in the gender-neutral sense).

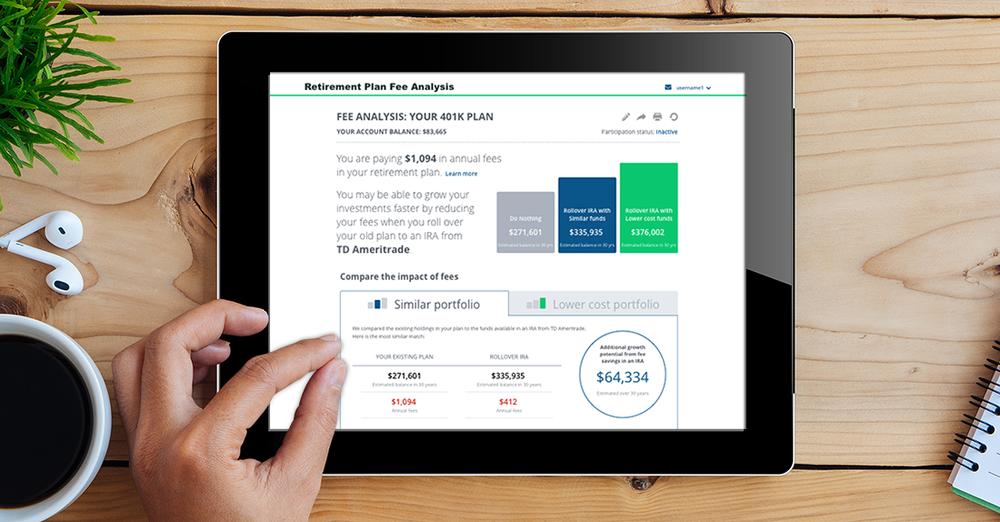

I know more than a few people who have found their Guy: a personal finance manager who promises to make retirement all anyone could ever hope for. They’ve got products that minimize risk and maximize gain. They promise they can beat the market and, in return, ask for a mere few points off the top. You know, for the effort.

I don’t buy it for a second.

Continue reading →